By EconMatters

Considering it costs $2.5 to $5 Billion from the initial Research phase to bringing a new drug to market, the $32 Billion in VRX Debt given their other assets, and proven drug portfolio makes this stock look cheap here on a valuation basis.

I bet I could find a buyer willing to pay $50 a share for Valeant Pharmaceuticals over the weekend if Bill Ackman wasn`t in such a hole on this stock, and needs a much higher price given the average stock price on his accumulated share stake.

Given that there is going to be further consolidation in this space, and the high costs associated with organically generating new drugs for the marketplace with no guarantees of success - VRX looks like an attractive take-out candidate to me. Their debt is actually in line with many utilities trading at much higher valuations with much lower revenue generation capabilities from both an overall margins and gross profit standpoint.

� EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

EconMatters

Friday, June 24, 2016

Markets Gone Risk-off After Brexit

The shocking news that the UK voted to leave the European Union has triggered a new phase of risk-off sentiment around the world. It�s anyone�s guess how this all plays out, but the initial reaction is deeply bearish. Yes, it could all be overblown, but the crowd is inclined, once again, to run first and ask questions later. �This is the biggest shock to European politics since the fall of the Berlin Wall,� Rob Ford, professor of politics at Manchester University, tells Bloomberg.

The shocking news that the UK voted to leave the European Union has triggered a new phase of risk-off sentiment around the world. It�s anyone�s guess how this all plays out, but the initial reaction is deeply bearish. Yes, it could all be overblown, but the crowd is inclined, once again, to run first and ask questions later. �This is the biggest shock to European politics since the fall of the Berlin Wall,� Rob Ford, professor of politics at Manchester University, tells Bloomberg.World equity markets are tumbling today, but the real test will probably come next week, after the world digests the news over the weekend. Meantime, the appetite for safety has soared.

The 10-year German Bund yield is back in negative territory, dipping to -0.08% (as of 6am NY time), as investors rush back to a safe haven. Futures trading for US stock indexes are down sharply in early trading, following routs in Europe and Asia on Friday. Suffice to say, the notion of a Fed rate hike is dead in the water for the foreseeable future.

The main question is what impact will all of this have on the real economy? No one knows, although the initial view is that Brexit comes with a price tag. Exactly how much a macro haircut awaits, if any, is to be determined. Ground zero, of course, is Britain. Economists have been warning that a vote to exit the EU would take a bite of Britain�s GDP, perhaps leading to a mild recession in the months ahead. Europe, too, would suffer a degree of blowback. The bigger unknown is whether there are ramifications for the US and elsewhere?

Lots of questions, but few answers at the moment. For the moment, it�s all about sentiment, which has turned sharply negative. Markets are discounting trouble, and there�s sure to be no shortage as the ugly details of how the UK will disentangle itself from the EU emerge in the months ahead.

As for the US stock market, the crowd as recently as yesterday (Thurs., June 24) was feeling jovial. The S&P 500 surged 1.3%, approaching its highest level in months. But if the rally this week was predicated on Britain staying in the EU, a major attitude adjustment is scheduled for Friday.

In the short run, nothing much, if anything, will change in terms of fundamental adjustment of regulations, trade, etc. Implementing Brexit will take time, several years, in fact. But it�s coming and because markets are forward-looking machines there will be a constant discounting process underway for some time, perhaps with turbulent results.

The blowback from Brexit probably won�t be as bad as the pessimists think, but it won�t be trivial either. As the markets struggle to find out where equilibrium lies, there will be substantial risk and opportunity� and lots of volatility. Separating the wheat from the chaff isn�t going to get any easier, and it may be a whole lot tougher. But for good or ill, it seems that regime change has arrived� again. Now comes the hard work of figuring out what it means, or doesn�t.

About the Author - James Picerno is a veteran financial journalist since the early 1990s at Bloomberg, Dow Jones, etc. before becoming an independent writer/analyst/consultant in 2008. James is also the author of Dynamic Asset Allocation (Bloomberg Financial, 2010) and he writes at The Capital Speculator. (Author Archive here)

and he writes at The Capital Speculator. (Author Archive here)

The views and opinions expressed herein are the author's own, and do not necessarily reflect those of EconMatters. � EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

Brexit: The Biggest Shock to Europe Since the Fall of the Berlin Wall

|

The result of the U.K. referendum on European Union membership has been a surprise and massive shock to so-called �expert� opinion.

And not just to academic opinion: The betting markets, which are supposed to be inhabited by experts at setting odds, were assigning just a one-in-seven probability to a majority for �leave� on the eve of the vote.

How then are we to understand this surprising outcome?

A dismal economy

In my view, understanding it starts with acknowledging the dismal performance of the British economy, which was arguably the real underlying subject of the referendum vote.

Government figures released earlier this year showed that Britain now has the largest productivity shortfall relative to the other G7 countries since official record-keeping started in the early 1990s. Hopes in the first half of last year that the country�s tepid productivity growth might be accelerating were disappointed by subsequent data releases. Productivity in manufacturing is particularly bad, lower in 2015 than in 2010.

Stagnant productivity has meant stagnant wages and living standards. The problem is acute insofar as income gains in the U.K., like in the U.S., have accrued disproportionately to the top one percent and, in the British case, to greater London, where �leave� support was least.

It is worse insofar as unemployment is concentrated disproportionately among the less skilled � where the less skilled, again, were most inclined to vote leave. It is worse still to the extent that the social services on which working-class people rely, notably the National Health Service (NHS), have been cut to the bone.

There is no easy solution to the productivity problem, only hard choices and costly investments. Easier than confronting the problems in question, therefore, is to blame immigrants and heavy EU regulation, as many leave supporters were inclined to do.

Addressing the real problems

But in fact the U.K. has the most lightly regulated economy in Europe, and it is not immigrants who are responsible for the low productivity of British manufacturing.

To be sure, addressing the real problems through more investment in infrastructure, research and development, education and training will take time. But this will at least give workers hope and, in this way, an alternative to Nigel Farage, the head of the UK Independence Party and a leader of the leave campaign.

Similarly, the government�s new National Living Wage, a higher minimum wage for workers aged 25 and over, will encourage firms to invest more in technology and training. It will also begin, if only begin, to address anger over inequality that is vented, albeit irrationally, on immigrants.

Adequate funding for the NHS and other social services can also help create the social solidarity needed to maintain public support for an open, internationally integrated economy. It is a well-known empirical fact � the Harvard economist Dani Rodrik famously established the point � that more open economies have larger governments.

Government has to provide insurance, in the form of temporary income maintenance and retraining, for workers displaced by foreign competition. It has to provide the education and infrastructure needed for them to compete with low-cost foreign labor. If it fails to do so, support for economic openness and integration will wither.

The British government under David Cameron and George Osborne neglected these responsibilities. Not surprisingly, supporters of leave saw the referendum as an opportunity to express their dissatisfaction not just with the EU, the symbol of openness, but also with their own government.

What�s next?

Given the outcome of the referendum, many people will be asking: Has �peak globalization� now been reached? Are we about to see a backlash against international integration more generally?

The answer could be yes, but only if governments fail to recognize that for globalization to be sustainable, they need to take public policy steps to ensure that its benefits are widely shared. If they fail to do so, their countries go the way of the U.K., and their leaders will meet the fate of David Cameron, who will step down.

Courtesy of Barry Eichengreen, The Conversation

Barry Eichengreen does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond the academic appointment above.

The views and opinions expressed herein are the author's own, and do not necessarily reflect those of EconMatters. � EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

GBP Collapses, Futures Crash, Oil Dives After Brexit

|

| Chart added by EconMatters |

Bookies turn into goofballs as financial carnage breaks out.

The omniscient bookies, who correctly predicted the vote in the Scottish independence referendum, have always favored the Remain campaign. Despite numerous polls to the contrary over the past few days, they upped the Remain vote�s chances of victory from 60% to 82% � near certainty!

And markets drank their Kool-Aid. All of it. And it tasted soooo good.

Based on an electorate of 46.5 million people, turnout at the referendum was 72.2%, a stunning figure by US standards. At 6:40 AM London time, the Leave vote wins with 51.9%, and the Remain vote loses with 48.2%.

As victory speeches of Leave campaigners ricochet across the UK and the world, it�s turning ugly for the financial markets.

|

| Chart added by EconMatters |

The UK pound, as I�m writing this, plunged 10% against the dollar, now at $1.34!

Equity futures in Europe are getting creamed. The London FTSE futures and the German DAX futures are down about 9%. The euro falls 3.7% against the dollar.

The carnage instantly spread to Asia, particularly Japan. The Nikkei has crashed through the 15,000 level, and is now at 14,870 down a breathtaking 8.4%, which brings its year-to-date loss to over 25%! Companies that depend on exports are getting crushed.

Investors are seeking refuge in Japanese Government Bonds, which jumped, as yields dropped. The 10-year JGB yield fell to negative -0.19%, the lowest ever, and is still falling as I�m writing this. The 20-year yield is hanging on to a positive number by its fingernails, now at 0.15%, and the 30-year yield isn�t far behind at 0.16%. At this rate, they�ll all be negative soon. The yen soars 4% against the dollar.

Hong Kong�s Hang Seng is down 5%. In China, a concerted effort is underway to keep stocks from spiraling out of control. The Shanghai composite almost hit the heavily defended 2,800 level after the mid-day break, down over 2%, but then bounced off and is currently down only 1.4%. The Indian Sensex, at mid-morning trading, is down 3.5%.

And what happened to the magnificent oil rally? WTI keeps skittering lower every time I look, now at $46.86, down 6.4%.

But gold spiked 6% to $1,338, but now appears to have second thoughts.

In the US, equity futures are turning uglier by the minute. The S&P 500 futures and Nasdaq futures are both down 4.7%. This is going to be a rough open for stocks. But Treasuries skyrocket, with the 10-year yield plunging to 1.44%!

Clearly, central banks are going to try to do their magic to manipulate markets back up. They�ve prepared for this for months. They�re going to try to make things bounce. And bottom-fishers are already lining up to dive into the markets�.

This is what happens when markets believe only those soothsayers that confirm their wishful thinking. Over the past five days, stocks had rallied. Everyone brandished the bets of the bookies as proof that Brexit was toast, that the Brits would come to their senses and let go of their dreams and frustrations, and instead prop up the global markets with a resounding Remain vote. But voters turned out to have a will of their own.

Other countries in the EU now will also want their chances at an in-out referendum. The Dutch might be next. And it seems the tranquility of the past few months, and the big stock market rally it entailed in the US, might be in for a rougher ride as the future of the EU gets sorted out.

Courtesy of Wolf Richter, Wolf Street

Courtesy of Wolf Richter, Wolf Street

� EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

Who in SP 500 Have The Most Exposure To Brexit?

After the dust settles and some fundamental analysis is attempted, what analysts will try to calculate is which S&P500 sectors, and companies, have the most exposure to a post-Brexit UK, a country whose growth expectations have been slashed in angry retribution by all those sellside strategists and experts whose "scaremongering advice" was ignored, and which many banks now expect will promptly enter recession (for the variant perception read Albert Edwards' latest note, according to whom the dramatic sterling devaluation is precisely what the UK economy needs).

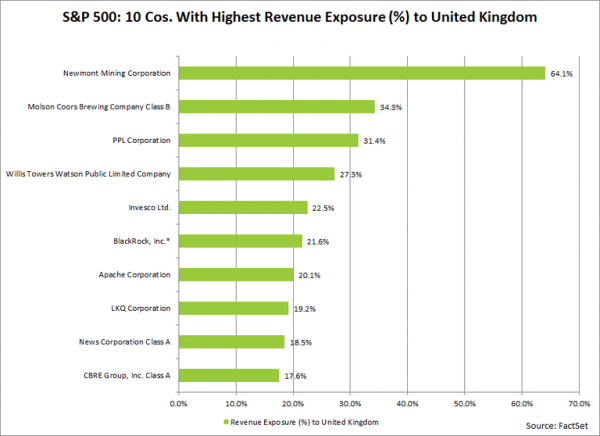

One place to start would be the following analysis from Factset, which analyses which sectors and companies in the index have the highest revenue exposure to the UK?

According to FactSet Market Aggregates and FactSet Geographic Revenue Exposure data (based on the most recently reported fiscal year data for each company in the index), the aggregate revenue exposure of the S&P 500 to the United Kingdom is 2.9%. This is the third highest country-level revenue exposure for the index, trailing only the United States (68.8%) and China (4.9%).

At the sector level, the Energy (6.4%), Information Technology (4.0%), and Materials (3.7%) sectors have the highest revenue exposures to the United Kingdom.

At the company level, 30 companies in the S&P 500 have revenue exposure of more than 10% to the United Kingdom, led by Newmont Mining (64%), Molson Coors Brewing (34%), and PPL Corporation (31%).

It is interesting to note that since February 20 (the date the UK announced the June 23 timeline for the EU vote), the companies in the S&P 500 with more revenue exposure to the UK have seen higher average and median price increases relative to the index as a whole.

For the entire S&P 500 index, the average price change for a stock from February 20 through June 16 was +11.3%. For the companies in the index with more than 10% revenue exposure to the United Kingdom, the average price change for a stock over this period was +16.7%. For the entire S&P 500 index, the median price change for a stock from February 20 through June 16 was +9.6%. For the companies in the index with more than 10% revenue exposure to the United Kingdom, the median price change for a stock over this period was +14.3%.

Courtesy Tyler Durden, founder of Zero Hedge

The views and opinions expressed herein are the author's own, and do not necessarily reflect those of EconMatters. � EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

Watch America's �Zombie States Deteriorate Faster, Further�

During the Financial Crisis, it was California that made the headlines with �out-of-money dates� and fancy-looking IOUs with which it paid its suppliers. The booms in the stock market and the startup scene � the state is desperately hooked on capital-gains tax revenues � but also housing, construction, etc. sent a flood of moolah into the state coffers. Now legislators are working overtime to spend this taxpayer money. Gov. Jerry Brown is brandishing recession talk to keep them in check. Everyone knows: the next recession and stock-market swoon will send California back to square one.

Now Puerto Rico is in the headlines. It�s not even a state. And it�s relatively small. But look at wild gyrations by the federal government and Congress to deal with it, to let the island and its bondholders somehow off the hook.

But Puerto Rico may just be the model. Big states are sliding deeper into financial troubles, particularly New Jersey, Connecticut, and Illinois.

These three states hold the top positions in the �Zombie Index� that Bill Bergman, Director of Research at Truth in Accounting, developed two years ago. California has dropped to 7th place. Whew!!!

The Zombie Index for the 50 states is based on three main factors:

- Truth in Accounting�s �Taxpayer Burden� measure of state finances

- The timeliness of state financial reporting

- And the share of total debt effectively �hidden� off the balance sheet.

This �taxpayer burden� is not a reflection of actual state taxes paid, but of the state�s total liabilities per taxpayer � such as outstanding bonds and loans and off-balance-sheet liabilities such as for pensions.

In explaining the Zombie Index, Bergman writes in his article, �Zombie states deteriorating faster and further�:

The index is named after a term coined by Ed Kane, professor of finance at Boston College. Kane wrote two books warning us about the S&L crisis back in the 1980s and early 1990s, before we knew what hit us. Kane used the term �zombie bank� to identify insolvent firms that were allowed to stay open by regulators, frequently with the aid of false regulatory accounting principles that delayed the recognition of insolvency.Many of these firms ended up �gambling for resurrection,� in Kane�s terms, and these incentives ended up trebling the cost of the S&L crisis when many gambles went sour.

In an article two years ago, when Bergman introduced the Zombie index, he wrote:

Kane�s careful history indicates that this risky behavior and the financial conditions of these zombie banks were hidden by less-than-truthful accounting practices. There are alarming parallels to the financial crises faced by many state and local governments today.These questionable accounting practices have allowed hundreds of billions of dollars of pension debt to accumulate outside governments� audited balance sheets.

This state of affairs is all the more ironic in light of the balanced-budget requirements that are widespread in state and local governments. Government leaders regularly proclaim their fidelity in living up to the spirit of these laws. But false accounting practices have allowed real expenses (and debt) to accumulate anyway.Taxpayers and citizens have been left in the dark.

So here are the top ten winners on this honorable Zombie Index:

Based on the 2015 financial reports that are now available, Truth in Accounting did some digging and found two trends:

- Larger states tend to show greater deterioration in their �Taxpayer Burden� from 2014 to 2015, as well as from 2009 to 2015.

- And states ranking high on my Zombie Index have been getting worse, as well.

Here�s a chart of 22 states for which Truth in Accounting analyzed the 2015 financial results. It compares their five-year average Zombie Index rankings (so not the most recent rankings as in the table above) to the change in their �Taxpayer Burden� from 2009 to 2015. It shows that the worst states on the Zombie Index (red markers, 5-year average rankings on the Zombie Index axis) are also those states whose �taxpayer burden� has increased more (left axis).

Bergman paralleled these trends to the current �regulatory issues in banking�:

Sadly, and perhaps alarmingly, these findings may point to a �too-big-to-fail� problem in state government finances, similar to a TBTF problem in banking. We may have a significant moral hazard problem operating, if larger states are assuming their failures may be cushioned by federal resources.Especially if Uncle Sam has already been pursuing, in the words of the Financial Report of the U.S. Government, �unsustainable� fiscal policy.

Politicians can kick the can down the road for many years. It works for an amazingly long time. They can adjust accounting practices to where the biggest problems � such as obligations related to pensions and other retirement benefits � are neatly swept off the balance sheet and thus out of the public eye.

So politicians cycle through their offices, and they�re kicking the can happily down the road for someone else to kick down the road even further. But at some point, they�re going to run out of road. And then, like the S&Ls, they may end up �gambling for resurrection.�

They�re already doing it: For example, governments are issuing �Pension Obligation Bonds� � they�re borrowing money from Wall Street to fill the holes in the state�s obligations to the already underfunded pension systems, and they�re gambling that total investment returns are 7.5% for evermore, even after the most phenomenal stock, bond, and real estate booms in memory.

And then, much like the banks, they�re counting on a bailout from the Federal government or better yet the Fed. Because who can stomach seeing Illinois go bankrupt?

Courtesy of Wolf Richter, Wolf Street

The views and opinions expressed herein are the author's own, and do not necessarily reflect those of EconMatters.

� EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

The Brexit Carnage from a Trader`s Perspective (Video)

By EconMatters

The surprise Brexit event made for some fun trading with great price action opportunities last night - sort of like being in a hurricane without getting your house destroyed - there is something "energy" in the air.

� EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

The surprise Brexit event made for some fun trading with great price action opportunities last night - sort of like being in a hurricane without getting your house destroyed - there is something "energy" in the air.

� EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

Labels:

Bond,

bubble,

EconMatters,

Trading,

Video,

Wall Street

Subscribe to:

Comments (Atom)